The Beginner's Guide To Filling Out A W-4

We’ll walk you through a W-4 form and show you how to fill it out in five easy steps.

It’s important to note that only Step 1 and Step 5 are mandatory; the rest are optional.

We’ll walk you through a W-4 form and show you how to fill it out in five easy steps.

It’s important to note that only Step 1 and Step 5 are mandatory; the rest are optional.

Let’s take a look at seven red flags that might mean you’re living beyond your means and the steps you can take to get back on track.

Let’s take a closer look at the difference between these two terms and how each one impacts your loan.

Hopefully, you’re working hard at keeping that score high by using your cards and paying your bills on time. You may be wondering, though, if more is better. Should you open a few more and get more available credit? Or are too many cards a liability to your score?

Read on for the answers to all your questions.

Taking on debt can be an inevitable step for many businesses. A loan or a line of credit can provide a struggling business with the cash it needs to expand or fund a new venture.

When is it a good idea to take on business debt?

Businesses can benefit from taking out loans or opening new lines of credit under these circumstances:

Don’t get sucked in again! Before you say “yes” to a large purchase, ask yourself these 7 hard-hitting questions.

You just may end up leaving that “dream” product in the store.

Debt consolidation isn't a solution for everyone.

Let’s take a look at the questions you might ask yourself before you take on a debt consolidation loan.

There are a number of upcoming firsts for new homebuyers.

Check out these common homeowner situations to help you best prepare for them.

As a credit union member, you are uniquely positioned to manage your finances and watch your money grow on the best possible terms. Like the member of an elite club, you are entitled to exclusive privileges and individualized service, courtesy of your credit union.

Let’s take a quick look at some of the benefits you can enjoy as a member of ASE Credit Union.

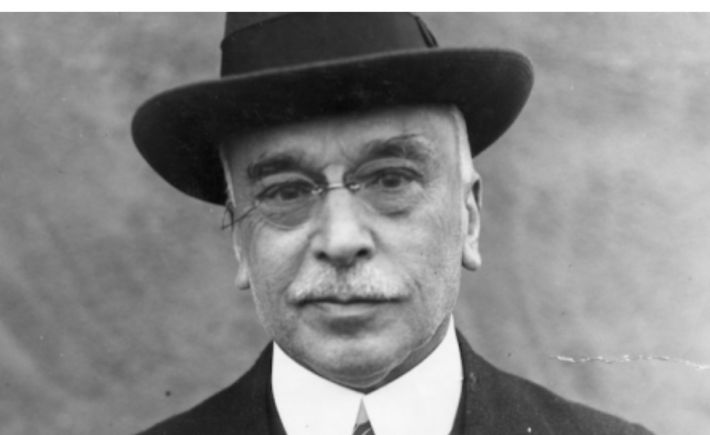

The noble goal of putting members first is deeply rooted in the rich history of the credit union movement. Let’s take a quick look at the backstory of credit unions and how they came to be the thriving financial institutions we know today.