The Importance of Being Financially Fit

Being financially fit is crucial for a well-balanced, stress-free life. Here’s why (and how):

Being financially fit is crucial for a well-balanced, stress-free life. Here’s why (and how):

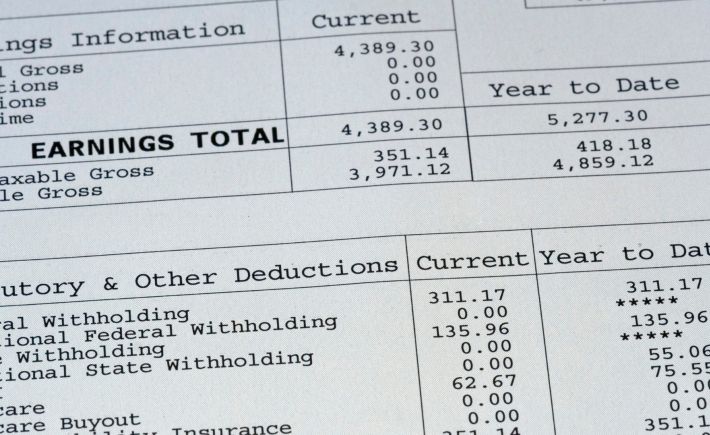

The paystub will summarize all the information from your paycheck and provide a total for net pay.

Before reviewing the actual numbers, let’s take a moment to explore the way a paystub is structured.

Investing your funds is a great way to grow your money and secure your financial future; however, choosing a first investment can be tricky.

Here’s all you need to know about the most common beginner investments and how to choose the path that best suits your needs:

Whether you’re only thinking about having a baby, or your due date is fast approaching, there’s no need to stress about finances. By taking the necessary measures today, you can learn to cover these new expenses without falling into debt.

Here are some steps you can take to prepare financially for a new baby:

A home inspection will set you back several hundred dollars, but it can easily save you thousands down the line. Before you officially become the new owner of the house, learn all you can about its general condition.

Here are 7 reasons you don’t want to skip a home inspection:

One excellent option we offer our members to help their savings grow is our share certificates. Sometimes known as savings certificates, and referred to by banks as CDs, these unique accounts blend higher growth potential of a stock investment with the security of a typical savings account.

Let’s take a closer look at this savings product and why it might be the perfect choice for you.

Debt consolidation is the process of moving several (possibly) high-interest debts into a new loan or line of credit. Debt consolidation can help you pay off your debt quicker, with less money going toward overall interest payments.

Here’s what you need to know about debt consolidation:

Whether you’re a long-time homeowner or you’ve just started shopping for your dream house, you’ve seen stacks of papers full of acronyms. Buried amid the dense undergrowth of legalese are three letters that could be costing you more than you think.

Be on the lookout for PMI: Private Mortgage Insurance.

Online shopping was already big before the pandemic, but now it's gone nuts. We're buying everything online now, but there are tricks to help you save big bucks!

Here are some tips for saving money when shopping online:

If you’re like many of us, you’ve been trying to stick to a budget for a while, but by the time each month is over, you’ve busted your budget – again.

Because of this recurring pattern, you’re probably wondering if there’s a better way. Fortunately, the answer is yes!